Covid-19 Impact on Metal Powder Market Size 2020 | Brief Analysis by Top Companies, Share, Size, Demand, Opportunities and Trends till 2027

Key Highlights

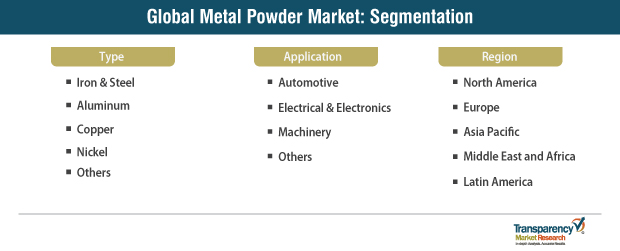

- The global metal powder market was valued at ~ US$ 6.8 Bn in 2018, and is anticipated to expand at a CAGR of ~ 4% during the forecast period.

- The iron & steel type segment accounted for a major share of the global metal powder market in 2018.

- The automotive application segment held a significant share of the global metal powder market in 2018. Around 96,804,390 vehicles (including passenger, light commercial, and heavy commercial vehicles) were sold across the globe in 2017.

- Asia Pacific is estimated to be one of the high growth regions of the global metal powder market, owing to increase in the demand for metal powders from the rapidly expanding automotive industry.

Key Drivers of the Metal Powder Market

Key Drivers of the Metal Powder Market- High growth in the automotive industry is driving the metal powder market. Components manufactured from metal powders are employed in the production of an extensive range of automotive components. Key components manufactured by using metal powders include transmission parts, engine parts, oil pumps, exhaust systems, and chassis components.

- The manufacturing components from metal powders through powder metallurgy offers 40% or higher cost savings than other technologies due to low energy requirements. The process deploys up to 97% of the total metal, while consuming 43% less energy than conventional technologies. Powder technology can be employed to produce high-value components such as gears, bearings, and shafts. Hence, expansion in the automotive industry and rise in sales of automobiles are projected to drive the demand for metal powder in the near future

- The demand for powder metallurgy to manufacture airframes is likely to increase in the aerospace industry due to the rise in usage of composites, titanium, and new aluminum and magnesium alloys. The need for more efficient engines is anticipated to encourage producers to develop higher-strength materials that can operate at higher temperatures.

- The demand for powder metallurgy-based superalloy components is high in various applications, such as turbine discs, as these do not possess solidification defects inherent in castings and cast and wrought alloys. This fuels the growth of the metal powder market.

Request for Report Sample @ https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=69533

Asia Pacific Prominent Region of the Metal Powder Market

- Asia Pacific was the key region of the global metal powder market in 2018, primarily owing to the high growth in the automotive industry in China, India, and Japan.

- China accounted for a prominent share of the metal powder market in Asia Pacific in 2018. The availability of low-cost labor and attractive incentive policies from the Government of China is encouraging major automotive producers and electrical & electronics manufacturers to strengthen their position in the country. Therefore, the rise in automotive production is expected to propel the demand for metal powders in China during the forecast period.

Global Metal Powder Market – Key Developments

- In May 2019, GKN Powder Metallurgy opened its new powder metallurgy headquarters and Additive Manufacturing (AM) Customer Center in North America. The 38,260 square foot facility, located in Auburn Hills, Michigan, helped the company expand its global 3D printing network and scope of in-house powder metallurgy capabilities.

- In June 2017, GKN Hoeganaes declared that it had started the production of titanium powder for additive manufacturing, at its additive manufacturing facility co-located with its Powder Innovation Center in Cinnaminson, New Jersey, the U.S. This new powder atomizing facility is a part of the joint venture with Germany-based TLS Technik. It provides customers with a source of titanium and other specialized powders for additive manufacturing.

- In May 2017, Sandvik Osprey Ltd, a global leading producer of gas atomized metal powders for advanced applications in net shape manufacturing, stated that, it had entered into a partnership with Desktop Metal Inc. to be a preferred supplier of a range of alloy powders for its recently-released 3D printing systems: DM studio and DM production systems.

- In June 2014, Rio Tinto established a new metal powder annealing facility in China. The US$ 5 Mn plant in Suzhou, China, is expected to expand the company’s production capacity of metal powder by 8,000 metric tons/year, and help boost its supply to the market in China.

Explore Transparency Market Research’S Award-Winning Coverage of the Global Industry @ https://www.prnewswire.com/news-releases/sales-in-advanced-materials-market-to-touch-28-kilo-tons-by-2027-manufacturing-end-use-industry-to-benefit-from-high-performance-structural-materials-tmr-301105755.html

Global Metal Powder Market – Competition Landscape

- The global metal powder market is highly fragmented with the presence of a large number of players.

- High capital investments and ongoing technological advancements in the metal powder market are anticipated to lower the threat of new players in the market.

- Key players operating in the global metal powder market include Rio Tinto, Höganäs AB, GKN Plc., Sandvik AB, BASF SE, JFE Holdings, Inc., Vale S.A., Alcoa Corporation, Laiwu Iron & Steel Group Powder Metallurgy Co., Ltd, GGP Metalpowder AG, Sarda Industrial Enterprises, Metal Powder Company Limited (MEPCO), The Arasan Aluminium Industries (P) Ltd, MMP Industries Ltd. (MMPIL), Deva Metal Powders Pvt. Ltd, Shakambari Enterprises (India) Pvt. Ltd., Innomet Powders, Sri Kaliswari Metal Powders Pvt Ltd, Industrial Metal Powders (India) Pvt. Ltd., and D M Metal Powder.

Request for Covid-19 Impact Analysis @ https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=69533