Impact Of Outbreak Of Covid-19 On Corn Starch Industry Size | Strategic Analysis | Global Outlook | Increasing Demand With Leading Key Players

Corn starch is also referred to as maize starch or corn flour. It is produced from the endosperm of the kernel. The starch has wide application range in the household, industrial, and culinary purposes.

In culinary, corn starch is extensively used as a thickening agent for gravies, pies, soups, sauces, glazes, desserts, and casseroles among others. It is also used in manufacturing bio-plastics and preparation of corn syrup.

Primarily, corn starch is gluten free in nature and is made from corn and only contains carbohydrate.

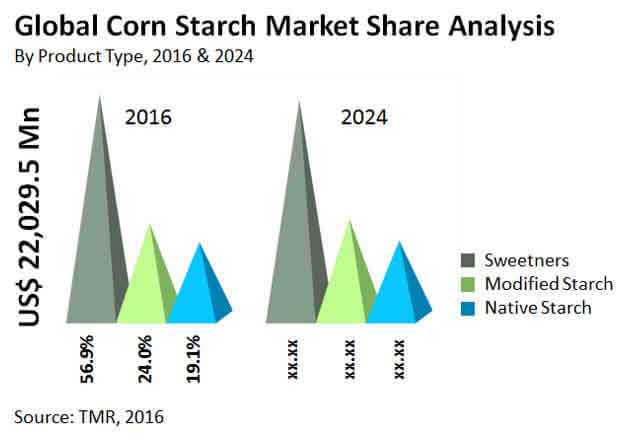

The corn starch market is categorized on the basis of product into native starch, modified starch and sweeteners. Among all the segments, sweetener is anticipated to be one of the leading segments in the corn starch market, owing to rising awareness regarding the use of sweeteners in various regions. The sweeteners derived from corn starch are usually cost-efficient.

Use of other source derived starches such as rice starch, potato starch, and tapioca starch among other starches is likely to interfere with growth of the corn starch market during the forecast period. In addition, rising prices of raw material is increasing price of the product subsequently. This, in turn, is hindering the adoption rate of the corn starch in various end-user industry.

Nevertheless, growing trend of substituting petroleum with ethanol is anticipated to be one of the key driving factors for the corn starch market during the forecast period. As per market analyst, the global corn starch market is likely to witness exponential growth in coming years. The growth rate is attributed to growing usage of corn starch in food and beverages industry, processed food, detergent industry, and paper and board industry among others.

Global Corn Starch Market – Overview

The increasing consumption of convenience and ready to eat foods and a solid year on year growth in textile and paper industry are projected to create a highly fertile landscape for the development of the global sales of corn starch, particularly in the regional segment of Asia Pacific. These projections are according to the research report published by Transparency Market Research about the global corn starch market. Customers of corn starch are now trying to seek different alternatives to cane sugar that are less expensive and yet easily fit into several applications. This has helped in creating a huge demand for corn starch.

According to the research report by Transparency Market Research, the global corn starch market is expected to exhibit a CAGR of 4.8% over the course of the given period of forecast ranging from 2016 to 2024. Initially, in 2016, the global market was valued at US$22.1 Mn. Naturally, with the given rate of growth, the valuation of the global market is expected to be even more stellar in the coming years of the forecast period.

The high output of maize that has superior starch content, is expected to be one of the key driving factors for the overall development of the global corn starch market. In the meantime, an increasing number of substitutes or alternatives such as tapioca are likely to hamper the development of the global corn starch market.

Request for Report Sample @ https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=328

Segment of Sweeteners to Account for Largest Market Share

The research report by Transparency Market Research classifies the global corn starch market based on type of product, base, and region. Based on product, the market is segmented into sweeteners, modified starch, and native starch. Among these, the segment of sweeteners is currently dominating the global corn starch market. The segment accounts for more than 50% of the overall share of the global market. However, a promising growth is projected for the segment of modified starch. The segment is expected to showcase a healthy CAGR of 5.4% during the course of the given period of forecast. The increasing usage of high fructose corn syrup (HFCS) in wide range of food and beverage products is expected to keep the demand for corn starch high in these upcoming years.

In terms of application, the global market for corn starch is segmented into paper and corrugated, textile, pharmaceutical and chemicals, animal feed, food and beverages, and others. In 2015, the segment of food and beverages accounted for the largest share in the global market for corn starch. It is projected that the segment will continue to dominate the global market over the course of the period of forecast.

Request for Covid-19 Impact Analysis @ https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=328

Asia Pacific to Show Maximum Rate of Growth

In terms of geographical segmentation, there are five key regions of the global corn starch market. These regions are North America, Latin America, Europe, Middle East and Africa, and Asia Pacific. Of these, the current market scenario is being dominated by the regional segment of North America. The region is leading in terms of both volume as well as value. However, in coming years, the regional segment of Asia Pacific is projected to show a promising CAGR of 6.4% over the given period of forecast. There is a growing demand for corn starch across Asia Pacific, particularly in countries such as India, China, and other ASEAN nations. The key manufacturers in the global market have considerably invested in the region to reap lucrative profits. Moreover, the market in the Middle East and Africa are projected to witness a promising rate of growth in coming years.

Some of the key players in the global corn starch market are Cargill, Incorporated, Archer Daniels Midland Company, Kent Corporation – Grain Processing Corporation, Associated British Foods plc, Global Bio-chem Technology Group Company Limited, Tereos Syral S.A.S, Roquette Frères S.A., Tate & Lyle PLC, Ingredion Incorporated, and AGRANA – Beteiligungs AG.

For More Info View @ https://www.transparencymarketresearch.com/casestudies/food-and-beverages-case-study