Impact of Outbreak of COVID-19 on Aquafeed Market: Overview, Status, Driving Factor Analysis, Competition Status, Sales, Revenue and Forecasts to 2026

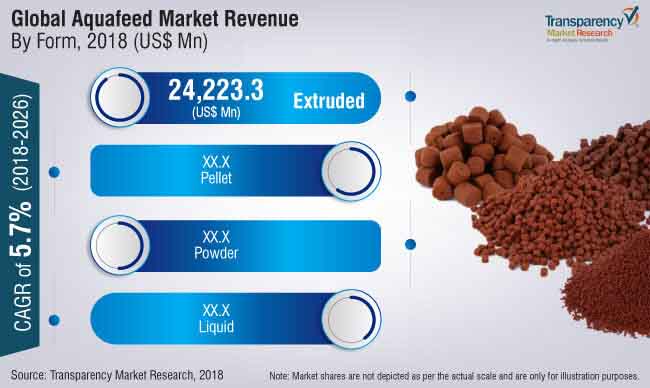

With reference to the latest market forecast report published by Transparency Market Research, titled ‘Aquafeed Market: Global Industry Analysis and Opportunity Assessment 2018-2026’, revenue generated from the global aquafeed market is estimated to be valued at around US$ 52,553.8 Mn in 2018, which is projected to increase at a CAGR of 5.7% during the forecast period (2018-2026).

Factors such as customers shifting towards plant-derived feed ingredients, high demand for aquaculture commercialization, and automated feed dispensers for feed optimization are the key reasons driving the growth of the aquafeed market over the forecast period. Asia Pacific is the major consumer of aquafeed, and is estimated to contribute around 44.2% value share of aquafeed over the forecast period, owing to an improved supply chain system and increased focus towards high digestibility feeds in the region. Increased penetration in the market by key aquafeed producers in developing economies makes the aquafeed market highly competitive, resulting in steady launches and expansion of aquafeed products in the aquafeed space. Players such as Cargill, Inc. and Archer Daniels Midland are well-known for their quality premium aquafeed products. These companies spend enormously on the research and development of aquafeed products, and also promote their brands through knowledge-based advertisement, resulting in larger market shares in the global aquafeed market.

Request for Report Sample @ https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=31064

Increased Press Movement for Aquafeed

For the past few years, an increase in press movement has been observed all over different platforms of media, including the Internet, for aquafeed products, especially crustaceans feed, which is expected to drive more demand for aquafeed products over the forecast period. A major shift has been noticed in the Indian aquafeed sector after 2009. The introduction of Whiteleg shrimp into the region has changed the whole fishery sector’s topography. The aquaculture market captured 48% of the total production during 2009. It overtook capture production and reached more than 52% in 2015, which also signifies the increase in demand for aquafeed over the years.

Explore Transparency Market Research’S Award-Winning Coverage of the Global Industry @ https://www.prnewswire.co.uk/news-releases/plastic-antioxidants-market-to-reach-us-1-4-bn-by-2027-massive-growth-potential-and-robust-cagr-aids-the-influx-of-new-players-in-global-market-tmr-822002147.html

India, a Potential Market for Aquafeed

Aquafeed in India has stepped up to address the global demand for initiatives from governments and other regulatory authorities, to increase focus over the export market. A number of reforms have been seen in the last few years. With heavy investments in the cold chain for aquafeed, the Government of India is proceeding over the action plan to regulate the whole aquafeed industry. This is being supported by a number of aquafeed key players who have gone public after successfully conducting business over the last decade. This is regarded as the indicators of growth for the aquafeed industry. With stricter quality control measures and investments in research and development, India is expected to easily penetrate into stricter markets of the European Union with its aquafeed offerings. Diversion of investments has been noticed in the last few years. Industry sources of aquafeed are indicating Tilapia to become a key player over the course of the next few years. With the huge demand in the international market, shrimp is expected to dominate as a key species in the Indian aquafeed market over the forecast period.

Increasing Per Capita Consumption of Fish in Europe

The increasing preference for a healthy source of nutrients is prompting consumers in Europe towards the purchase of good quality aquafeed for aquaculture production. This reason is expected to drive the growth of the European aquafeed market over the forecast period, as a steady growth in per capita consumption of aquaculture is anticipated.

According to the European Union, annual per capita fish consumption by European consumers reached 25.5 kg in 2014, an increase of 1 kg from 2013. This data clearly shows a rise in the consumption of fish, as such, indicating an increase in the consumption of aquafeed in the region.

Key Manufacturers of Aquafeed

This TMR report contains the current trends that are driving each market segment, and offers detailed insights and analysis into the potential growth of the global aquafeed market. The last part of the report includes the competitive landscape of numerous market players to provide a comprehensive and comparative dashboard. Major players covered in the report are the dynamic manufacturers who are currently present in the aquafeed market. A detailed view of the manufacturers has also been provided in the scope of the report to examine their short- and long-term strategies, recent developments, and key offerings in the aquafeed market.

Request forCovid-19 Impact Analysis @ https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=31064

Global Aquafeed Market: Competition Dashboard

TMR has profiled the most prominent companies that are active in the global aquafeed market, such as Alltech Inc., BENEO GmbH, Skretting, Cargill Inc., Cermaq, Sonac B.V, Aller Aqua A/S, Novus International, Clextral, Koninklijke DSM N.V., Archer Daniels Midland, Novus International, Biomin Holding GmbH, Ridley Corporation Limited Nutriad NV, Dibaq, Biomar, INVE Aquaculture Inc., Nutreco N.V, Zeigler Bros., Inc., and Norel SA, among others.

Global Aquafeed Market: Key Insights

Several manufacturers are entering new markets through the acquisition of major regional players in order to enhance their product offerings and manufacturing facilities. Moreover, companies are currently focusing on opening new innovation and development centers in order to expand and boost their regional and manufacturing capabilities in the targeted country, and enhance their presence accordingly.