Burgeoning Demand for Ferric Sulphate and Polyferric Sulphate to Fuel Market Growth Thorough the COVID-19 Crisis Period

XploreMR presents useful insights on the competitive landscape and key player strategies in a new study titled”Burgeoning Demand for Ferric Sulphate and Polyferric Sulphate to Fuel Market Growth Thorough the COVID-19 Crisis Period”

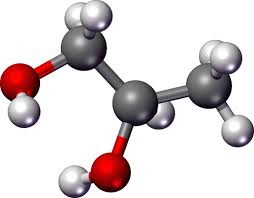

Polyferric Sulphate and Ferric Sulphate are iron based coagulants. Coagulants are the chemicals used for the primary treatment of sludge. They destabilise the particles by neutralising the charge on the particle with charges opposite to those of the suspended solids. Once the charges are destabilised, the particles are capable of sticking together. Ferric and polyferric sulphate is mainly used by different industries to treat waste water. These chemicals are used to assist with the removal of colour and turbidity present in untreated, raw water. They do this by forming particles in the form of flocs, which are then removed during downstream clarification or filtration treatment processes.

On the basis of product type, ferric sulphate and polyferric sulphate are different chemicals. Ferric sulphate is an inorganic ferric salt. It is a red-brown aqueous solution, typically sold in the market as a 50% or 60% strength solution on a dry basis. Polyferric sulphate (PFS) is a derivative of ferric sulphate. It is produced in two forms, i.e. solid and liquid. Polyferric sulphate is deep red or yellow in colour. According to the market analysis, Ferric Sulphate is expected to lead the market with a higher demand and reach a market value of over US$ 460 Mn by the end of 2027, growing at a CAGR of 4.4%. The market for Polyferric Sulphate lags behind and is expected to register a lower CAGR of 3.5% during the forecast period.

Get Sample Copy of this Report: https://www.xploremr.com/connectus/sample/739

Industries are considered one of the major sources of sludge. About 40% of the sludge produced globally is industrial sludge. The pace of industrialisation is accelerating rapidly. The increase in the number of industries globally, especially in the emerging economies of Asia and the Middle East will lead to an increase in sludge production from the industrial sector. The waste produced cannot be directly dumped in water bodies or on land. Due to stringent government regulations, companies are striving to decrease toxicity in industrial sludge, thereby boosting the demand for sludge treatment chemicals. The government has established various standards for the treatment of sewage sludge that could be applied to agricultural soil. It has also been made mandatory for the commercial sector to inculcate sustainable development as part of the corporate plan. This has also been a result of lack of fresh water. Over the last few decades, the rapid decline in the number of fresh water resources due to the misuse of water has resulted in severe water stress across the globe. Other than water purification, governments across the world have also increased their focus on water reusability.

Demand for ferric and polyferric sulphate to face a major setback due to new non-chemical technologies

Non-chemicals methods such as filters and membranes are growing at a faster rate as compared to the use of chemicals, especially for municipal sludge treatment plants, as the former is more hygienic and creates less pollution. The use of membrane bioreactors can eliminate the cost of tertiary treatment. The increased awareness and concerns towards climate change and more sustainable products may shift consumer demands towards water treatment technologies with lower chemical consumption, and this may have a negative impact on the ferric sulphate and polyferric sulphate market in the coming years.