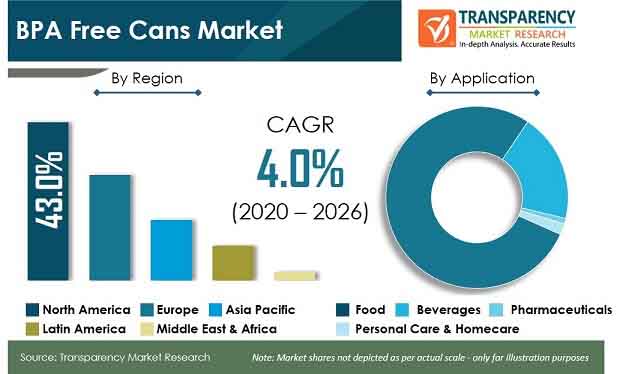

BPA free cans market is expected to expand at a CAGR of 4%

Transparency Market Research delivers key insights for the BPA free cans market in its published report, which includes global industry analysis, size, share, growth, trends, and forecast for 2020-2026. In terms of revenue, the global BPA free cans market is projected to expand about 1.3x its current market value by the end of 2026, owing to the ever-increasing demand from food industry sub-segments such as fresh fruits & vegetables and ready-to-eat food across several countries about which, TMR offers detailed insights and forecasts in the BPA free cans market report.

To Garner Compelling Insights on The Forecast Analysis of Market, Request a Sample Here

BPA free cans are used primarily in end-use industries, including food & beverages, pharmaceuticals, and personal care & cosmetics. BPA free can is a terminology used for metal and plastic cans, internally or externally coated with BPA-free coating solutions such as vinyl, acrylic, polyester, and oleoresins. BPA free cans have gained significant attention in the past few years due to increasing objections of usage of BPA for food packaging applications globally. TMR segmented the analysis of BPA free cans market based on various factors such as capacity, product type, material type, and application across five regions. As per the TMR analysis, 2-piece type of BPA free cans are expected to hold the largest market share during the forecast period, as it offers brand owners a modern, stylish way to market their products to end users due to its stackable feature, thus saving shelf space and non-toxic nature.

Growing Consumer Concern over BPA-based Products to Drive BPA Free Cans Market

Concerns over the use of BPA-based products have increased significantly in the past few years. Several organizations have invested hefty amounts in the research activities to find out health hazards of BPA-based products. Moreover, they are continuously engaged in creating public awareness to give up on BPA containing products such as metal cans. However, government in most countries still do not find BPA harmful and hence, have not banned the use of BPA in food contact applications. However, the decline in the use of BPA-based products in most of the developed countries is primarily driven by consumer disinterest but not by government enactments. Moreover, consumer disinterest in BPA-based products led food processing companies to switch their packaging products or use BPA free coatings in their metal can packaging format, which has ultimately increased the demand for BPA free cans.

- For instance, Del Monte Foods, Inc., a U.S.-based manufacturer and marketer of food products, stopped using BPA-based packaging products for all of their tomato and canned fruits & vegetables products

For More Actionable Insights into The Competitive Landscape of Market, Get a Customized Report Here

Food Industry to Remain Prime End User of BPA Free Cans

Fresh fruits & vegetables, ready-to-eat foods, sauces, dressings, condiments & soups, meat & seafood, and other such products are gaining traction in the global BPA free cans applications in the food industry from the past several years. Foods packed in BPA free cans help to significantly balance food waste, which constitutes an integral part of landfill stream. Not only do canned foods last longer but also pieces, such as cores & peels of fruits and vegetables, are used to feed livestock and create manure for healthier soil. Additionally, BPA free cans have less influence on the environment, as more than 99 percent of cans are made from steel and aluminum from which, an average 75 percent of the cans are sent for recycling, more than three times the amount in a glass or plastic products. These customer inclinations toward BPA free cans, combined with increasing ready-to-eat food consumption worldwide, will also help to fuel the growth of the global demand for BPA free cans.

Local Government Support Could Hamper BPA Free Cans Market Growth

According to the U.S. Environmental Protection Agency, Bisphenol-A (BPA) in food contact applications accounts for ~4-5% of the U.S. BPA free cans market. Despite being widely recognized as a harmful chemical, there is no scientific proof that BPA causes any chronic health hazards, thus BPA has not yet been completely banned by most countries for use in all food contact applications. Prominent companies engaged in the manufacturing of BPA-based epoxy coatings and cans are being supported by several associations. These associations are permitting a limited amount of BPA for food packaging applications. For instance,

- North American Metal Packaging Alliance (NAMPA), food & beverage metal packaging industry association is apparently supporting the use of BPA in food packaging applications. Besides this, according to FDA’s current perspective, based on its most recent safety assessment, is that BPA is safe for foods.

- The European Parliament has rejected calls to ban the chemical bisphenol A (BPA) from food and drink packaging, opting instead to adopt a limit for the amount of BPA used in food contact materials

BPA Free Cans Market: Competition Landscape

The global BPA free cans market is fairly consolidated in nature into which, larger portion of market share holds by well-established market players. Some new participants and local players are trying to enter into the market attributing to a major revenue creation with the rising demand for non-alcoholic and alcoholic beverages across the globe. Some of the key players operating in the global BPA free cans market are Crown Holdings, Inc., Ardagh Group S.A., Ball Corporation, Silgan Containers LLC, CCL Industries Inc., CAN-PACK Group, Toyo Seikan Co. Ltd., Kian Joo Group, CPMC Holdings Limited, HUBER Packaging Group GmbH, The Valspar Corporation, PPG Industries, Inc., DowDupont Inc., Kangnam Jevisco Co., Ltd., and among others.