Analysis of Potential Impact of COVID-19 on Water Pump Market Global Outlook by 2025

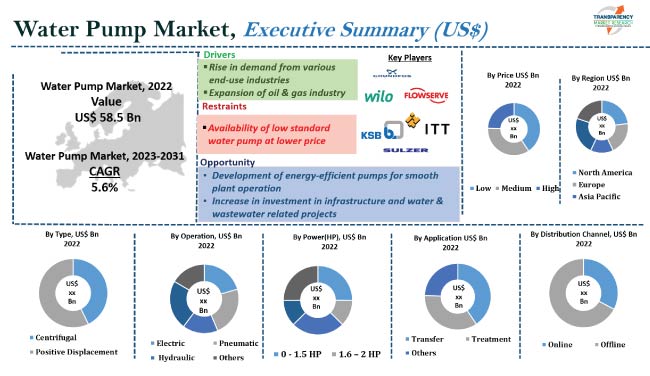

Transparency Market Research has recently observed that the sales market of global water pumps is strongly consolidated with the most prominent actors like Flowserve Corporation, Wilo SE, ITT Pumps, Sulzer, KSB Inc., Ebara Corporation, Xylem Inc. and Alfa Laval. Some of the significant purchases that occurred in 2013 included the takeover of Finder Pompe SpA by Dover, the acquisition by DXP Enterprises of Alaska Pump & Supply Inc. and the Xylem purchase of PIMS Group. Saudi Pump Factory, the biggest producer of pumps in the Gulf area, recently soldered 75% of its stake to Sulzer Ltd in 2014.

The inorganic growth of businesses reduces the competition between the sector in the market for water pumps.

New product growth, technological developments in products and acquisitions by worldwide conglomerates of smaller players are characteristic for the industry of water pumps.

But tiny, unorganized players who are able to develop and market economically efficient products to serve increasing customer pools in the emerging economies also face less serious entry obstacles. Although several international players are present, China’s small-scale vendors play a major part in the worldwide industry, serving low energy consumption and cost effective water pumps. The strategic partnerships, mergers and acquisitions carried out to consolidate the market in profitable regional pockets may assist global players to consolidate their competitive position in such conditions.

According to the study, the worldwide water pump industry in 2016 was estimated at U.S.$ 43,599 million, with a predicted growth of 4.9 percent from 2017 to 2025 to US$ 66,852 million by 2025.

Request for Report Sample @ https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=11171

Emerging Economies to Present Rich Growth Opportunity to Water Pumps Market

Asia Pacific is Europe and North America’s biggest water pump market. The Asia-Pacific water pumps industry is the largest growth rate, primarily because of the rise in the development of infrastructure in developing nations, such as India and China. Centric-fugal water pumps retain a majority of the market share in the products sections and are anticipated to continue to increase at a constant pace as demand from sectors such as petroleum, gas and municipalities is increasing. In Asia-Pacific, the oil and gas industry is the main end-user in water pumps, as industrial water pumps are also growing at a large pace because of the increased industrialization.

The growing amount of recycling and treatment plants for water waste, particularly in India and China, is fueling the market for water pumps in Asia Pacific. In the water pumping sector, new technology such as a smart pump system has extended its price to customers. Water pumps are used for several domestic applications, in addition to the water circulation, including water fountains, gardening facilities and water coolers.

Request for Covid-19 Impact Analysis @ https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=11171

Wastewater Treatment to Drive Water Pumps Market

In the coming years, the demand for water pumps is expected to rise owing to the growing need for industrial waste water treatment. In the developing Asian Pacific nations, the continuing fast infrastructural growth is expected to make a positive effect on the water pump industry in the near future. This market is anticipated to have a positive effect over the coming years due to fast urbanization and several infrastructure investments due to the growing disposable revenue of individuals. The development of the oil and refinery industry will probably add substantially to the water pump industry.

The fast urbanization sensitizes the use of clean water to keep life safe and healthy. Furthermore, the growing acceptance of solar water pumps is expected to further the worldwide water pump industry over the next few years. The government’s favorable efforts are projected to support the water pump industry growth over the forecast period, for example by introducing budgets where farmers in India only pay ten per cent of their solar water pump costs.

For More Info View @ https://www.transparencymarketresearch.com/casestudies/food-and-beverages-case-study