Impact Assessment of COVID-19 Outbreak on Ethylene Propylene Diene Monomer (EPDM) Market

Ethylene Propylene Diene Monomer (EPDM) Market: Key Highlights

- The global ethylene propylene diene monomer (EPDM) market was valued at ~ US$ 3.8 Bn in 2018, and is anticipated to expand at a CAGR of ~ 6% during the forecast period.

- The global ethylene propylene diene monomer market is driven by the rise in the demand for EPDM in automotive applications such as rear-lamp gaskets, hoses, tire sidewalls, inner tire tubes, front and rear bumpers, and braking systems.

- Asia Pacific accounts for a major share of the global ethylene propylene diene monomer market, led by an increase in the demand for EPDM for use in thermoplastics modification in the region.

Request Brochure – https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=1285

Key Drivers of the EPDM Market

- Ethylene propylene diene monomer, a type of synthetic rubber, is primarily used in automotive, roofing, and plastic modification applications. Ethylene propylene diene monomer is extensively employed in the automotive industry, owing to its chemical properties such as high temperature sustainability, and resistance to heat, harsh weather conditions, ozone, and steam.

- Highly volatile prices of natural rubber is a major factor that has compelled rubber consumers across the globe to shift from natural rubber toward synthetic rubber such as ethylene propylene diene monomer.

- Ethylene propylene diene monomer is widely used in the construction and civil engineering sector in applications such as mounting structures, bridge bearings, expansion joints, pipe couplings, water barriers, roofing membranes, rubberized asphalt, and concrete texturing.

Building & Construction Sector to Offer Attractive Opportunities

- Ethylene propylene diene monomer is an extremely durable, synthetic-rubber, roofing membrane that is widely used in low-slope buildings across the globe. Its two primary ingredients, i.e. ethylene and propylene, are derived from oil and natural gas.

- Ethylene propylene diene monomer is widely used in the building & construction industry, due to its properties such as resistance to cracks, water, and temperature. Thus, it is suitable to be used in roofing solutions in the construction industry.

- Ethylene propylene diene monomer offers properties such as high electric resistance and excellent electric insulation. Thus, it is used in various applications in the electric industry. EPDM is widely employed in the manufacture of low- and medium-voltage cable insulations, wires, and submersible water pumps, due to its water-repellent property.

- In the automotive industry, EPDM is used in hydraulic brake systems, wire and cable harnesses, tubing, window spacers, radiators, belts, weather stripping and seals, glass-run channels, and door, window, and trunk seals.

High Risk of Substitution to Hamper EPDM Market Growth

- The inert nature of EPDM, which reduces the adherence of the material when used in automotive and plastic applications, and high costs of installation of EPDM roofing systems are expected to hamper the demand for ethylene propylene diene monomer in these applications during the forecast period. Furthermore, ethylene propylene diene monomer exhibits unsatisfactory compatibility with most oils, kerosene, gasoline, aromatic and aliphatic hydrocarbons, concentrated acids, and halogenated solvents.

- The above-mentioned disadvantages of EPDM augment the usage of other elastomers, including NBR, polyurethane-based, and HNBR elastomers, in various applications.

- Furthermore, the oversupply of ethylene propylene diene monomer led by the rise in production capacities acts as a major restraining factor for players operating in the global ethylene propylene diene monomer market. EPDM remains oversupplied in Asia Pacific, with most plants in the region running at reduced pace. Major suppliers had to cut the prices of EDPM to boost buying sentiments. In China, ethylene propylene diene monomer prices have dropped by 8.5% since early October 2018, to reach US$ 2,150/ton on December 19, 2018.

More Trending Reports by TMR:

Asia Pacific a Prominent EPDM Market

- Asia Pacific dominated the global ethylene propylene diene monomer market in 2018. Growth of the automotive industry in developing economies such as China and India is likely to propel the ethylene propylene diene monomer market in the region during the forecast period.

- The ethylene propylene diene monomer market in North America is expected to expand at a significant pace during the forecast period, due to the high demand for lubricant additives, and rapid growth of the plastic, rubber, and automotive industries in the U.S. and Canada.

- The demand for EPDM roofing is rising in Spain, Italy, the U.K., and countries in Western Europe, due to the increasing demand for waterproofing solutions for use in non-residential and commercial buildings in these countries.

- Increasing demand for eco-friendly products as substitutes for PVC is projected to drive the TPE sector in North America. This, in turn, is likely to fuel the ethylene propylene diene monomer market in the region from 2019 to 2027.

Top Few Players Accounted for ~ 50% of EPDM Market Share in 2018

The global EPDM market is dominated by a few major players, and is consolidated in nature. The top six manufacturers – LANXESS AG, ExxonMobil Chemical Company, Kumho Polychem, Mitsui Chemicals, The Dow Chemical Company, and Lion Copolymer LLC – held ~ 70% of the market share in 2018. Other key companies that manufacture ethylene propylene diene monomer are Sumitomo Chemical Co. Ltd., Versalis S.p.A., SK Global Chemical Co. Ltd., and Johns Manville Inc.

- In April 2015, Lanxess started production of EPDM at its new plant at Changzhou in the Jiangsu province of China. The new plant, with 160,000 tons of annual production capacity, is located in Changzhou Yangtze Riverside Industrial Park. The plant produces ten premium grades of EPDM, tailored to the requirements of customers in Asia, especially China. However, in 2016, Lanxess AG planned to stop the production of EPDM rubber at its facility in Marl, the U.K.

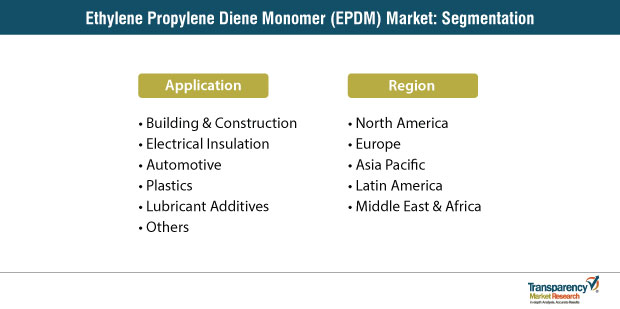

Global EPDM Market: Research Scope

EPDM Market by Application

- Building & Construction

- Electric Insulation

- Automotive

- Plastics

- Lubricant Additives

- Others (Including Rubber Goods and Wire & Cables)

EPDM Market by Region

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Russia & CIS

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- ASEAN

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

REQUEST FOR COVID19 IMPACT ANALYSIS:

https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=1285

About Us

Transparency Market Research is a global market intelligence company, providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision makers. Our experienced team of analysts, researchers, and consultants use proprietary data sources and various tools and techniques to gather and analyze information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.