5 mins read

Impact of COVID-19 on Geothermal Power Equipment Market Analysis, Industry Chain and Regional Forecast 2019 – 2027

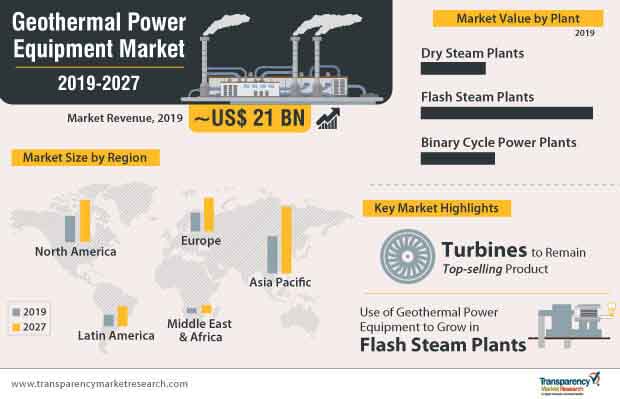

Geothermal Power Equipment Market: Key Highlights

- The global geothermal power equipment market was valued at ~ US$ 20 Bn in 2018, and is anticipated to expand at a CAGR of 5.5% during the forecast period.

- Among the plant types, the flash steam power plants segment accounted for a substantial share of the global geothermal power equipment market in 2018.

- Among the products, the turbines segment held a significant share of the global geothermal power equipment market in 2018.

- Asia Pacific is estimated to be the region with high growth potential for the geothermal power equipment market in the next few years, owing to the large-scale production of geothermal power in the Philippines, Japan, and Indonesia.

Key Drivers of the Geothermal Power Equipment Market

- Over the last few years, the focus on reducing dependence on coal and other fossil fuels has increased considerably across the world. Several new geothermal power projects are being established. Most of them are undergoing development, and they would start contributing to the global energy mix on a consistent basis in the next few years.

- Rise in the number of favorable government initiatives and policies regarding geothermal power is a key driver of the geothermal power equipment market. Various countries such as the U.S., Japan, and those in the European Union have enacted major energy policies geared specifically toward geothermal power plants. These include feed-in tariffs, tax credits, net metering, and capital subsidies. For example,

- In 2016, Japan’s Ministry of Economic Trade and Industry introduced feed-in-tariffs (FITs) of US$ 0.26 for less than 150-MW geothermal power plants and US$ 0.36 for greater than 150-MW plants.

- In 2013, the Government of Indonesia announced new feed-in-tariffs for geothermal power ranging from US$ 0.105/kWh (for projects with high-temperature resources and capacity of more than 55 MW) to US$ 0.19/kWh (for projects with low-temperature resources and capacity of up to 10 MW).

- These supportive policies are driving the global geothermal power equipment market.

Request A Sample of Geothermal Power Equipment Market – https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=30158

Asia Pacific a Prominent Region of the Geothermal Power Equipment Market

- Asia Pacific was the key region of the global geothermal power equipment market in 2018. Rising electricity demand in China and India, coupled with increasing government support to produce electricity through renewable resources is expected to augment the geothermal power equipment market in the region during the forecast period.

- Indonesia accounted for a prominent share of the geothermal power equipment market in Asia Pacific in 2018. Indonesia ranks second, globally, in terms of cumulative geothermal power capacity. Indonesia expanded its geothermal power capacity by 140 MW in 2018, surpassing the Philippines by a small margin, to rank second, globally, in terms of installed capacity. By the end of 2018, Indonesia had geothermal power plants of 1.95 GW capacity in operation. In North Sumatra, the 110-MW unit of the Sarulla plant was commissioned in 2018. Additionally, Indonesia started operations of its 30-MW Karaha Unit 1 in April 2018.

Global Geothermal Power Equipment Market: Key Developments

- In December 2018, the Velika Ciglena geothermal power plant, the first in Croatia and the largest Organic Rankine Cycle (ORC) system in Europe, started operations with the capacity of 17.5 MW. The investor is MB Holding, a Turkey-based construction company.

- In May 2018, Toshiba Energy Systems & Solutions Corporation signed a memorandum of understanding (MoU) with the Ministry of Natural Resources, Energy, and Mining of Malawi, to develop a partnership in geothermal power projects. As per the MoU, Toshiba Energy Systems & Solutions Corporation would be supplying major equipment to the Ministry for use in the country’s geothermal power plants.

- In May 2016, Japanese Toshiba Corp. announced to have received an order for a 72-MW flash steam turbine and generator system from Zorlu Enerji Elektrik in Turkey. The project is located in Kizildere in the province of Aydin. It is the largest facility of its kind in Europe and the Middle East.

- In 2017, Chile opened the new 48-MW Cerro Pabellon geothermal power plant, which was reportedly the first geothermal power plant commissioned in South America.

Request for Covid-19 Impact Analysis @ https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=30158

Global Geothermal Power Equipment Market: Competition Landscape

- The global geothermal power equipment market is highly fragmented with the presence of a large number of players.

- High capital investments and ongoing technological advancements in the geothermal power equipment market are anticipated to lower the threat of entry of new players in the market in the near future.

- Key players operating in the geothermal power equipment market include MITSUBISHI HEAVY INDUSTRIES, LTD, General Electric, Toshiba Corporation, Fuji Electric Co., Ltd., Ormat Technologies Inc., Boreal Geothermal, Loki Geothermal, Turboden S.p.A, Chevron Corporation, TAS Energy Inc., Ergil, and Ansaldo Energia S.p.A.

For More Info View @ https://www.transparencymarketresearch.com/casestudies/food-and-beverages-case-study